Analysts look for ratios returning to normalized levels after initial impacts subside. Companies must clearly state which expenses are operational and which are designated for other uses. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

How do fundamental analyses use operating Ratios?

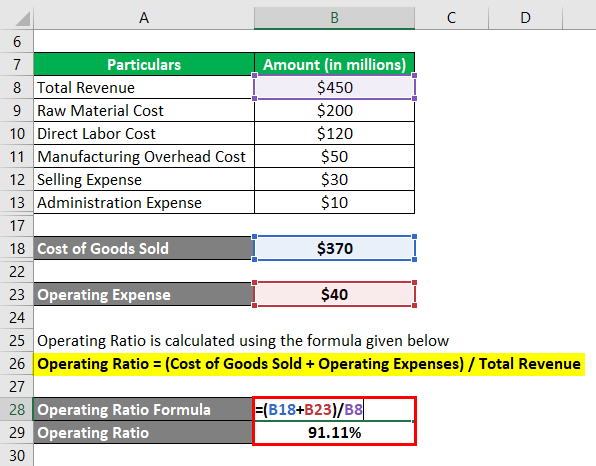

The economic order quantity eoq definition and formula is calculated as operating expenses divided by net sales or sometimes as operating expenses divided by gross profit. A declining ratio over time indicates the company is gaining operating leverage – meaning revenues are growing faster than operating costs, leading to expanded profit margins. This demonstrates management’s ability to control costs amid business growth and suggests future margins could continue improving with scale. Conversely, a rising operating ratio indicates costs are outpacing revenues and profitability is contracting over time – a potential red flag for future earnings power. One-time or non-operating expenses like interest, taxes, and extraordinary items are excluded to isolate the normal recurring costs of running the business.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

These direct costs are crucial as they directly impact the cost of goods sold (COGS), a fundamental component in calculating gross profit. For businesses, particularly those in transportation and logistics, the operating ratio is a critical metric. It serves as an indicator of operational efficiency by comparing operating expenses to revenue. A lower operating ratio signifies better performance, making it a key focus for companies aiming to optimize their financial health.

Operating Efficiency Ratios Explained in Video

In most cases, an operating ratio below 100% is preferred as it indicates the company is generating more revenue than it is spending on operating costs. This means the business is operationally efficient and earning an operating profit. An operating ratio of 100% means revenues exactly equal operating expenses – the company is at breakeven. For example, a company running at a 20% operating ratio is able to convert five rupees of revenue into four rupees of contribution towards fixed expenses and profit. This 20% ratio indicates consistency in the operating leverage of the company if it remains constant over time. The business is exhibiting consistent conversion of sales growth into earnings growth.

It is calculated by dividing a property’s operating expense (minus depreciation) by its gross operating income. The operating ratio for Apple means that 72% of the company’s net sales are operating expenses. Apple’s operating ratio must be examined over several quarters to get a sense of whether the company is managing its operating costs effectively.

Days of Inventory on Hand (DOH)

For example, a company may be highly leveraged and must therefore make massive interest payments that are not considered part of the operating ratio. Nonetheless, this ratio is commonly used by investors to evaluate the results of a business. Manufacturing industries can display a wide range of operating ratios depending on the efficiency of production processes and the cost of raw materials. Companies that have invested in automation and lean manufacturing techniques may have lower operating ratios, indicating a more efficient use of resources.

- A higher operating ratio, therefore, signals lower cash generation capacity, impacting valuation.

- Higher ratios are generally better, illustrating the company is efficient in its operations and is good at turning sales into profits.

- Maintaining a lower operating ratio is a good way to achieve operational efficiency.

- This uncovers whether rising costs are tied to factors like input costs, labor, excess capacity, or other factors, providing color into the root causes behind improving or deteriorating operational leverage.

Operating margin takes into account all operating costs but excludes any non-operating costs. Net profit margin takes into account all costs involved in a sale, making it the most comprehensive and conservative measure of profitability. Gross margin, on the other hand, simply looks at the costs of goods sold (COGS) and ignores things such as overhead, fixed costs, interest expenses, and taxes. The operating margin should only be used to compare companies that operate in the same industry and, ideally, have similar business models and annual sales. Companies in different industries with wildly different business models have very different operating margins, so comparing them would be meaningless.

It also helps in establishing how the company’s management is instrumental in reducing costs. The gross margin tells us how much profit a company makes on its cost of sales or COGS. In other words, it indicates how efficiently management uses labor and supplies in the production process. An investor has to weigh Costco’s operational efficiency against Walmart’s higher margins, pricing power, scale, and omnichannel presence.